TikTok continues to give us challenges that sometimes seem fun, sometimes strange and sometimes make us stop to reflect. One of the latest challenges that is making a name for itself is what is called the "no-spend challenge". With thousands of videos under the hashtag #nospendchallenge, users and financial experts share their experiences of the savings that can be achieved by limiting spending for 30 days.

But does this challenge really work? And, more importantly, is it healthy for your relationship with money?

What's a no-cost challenge?

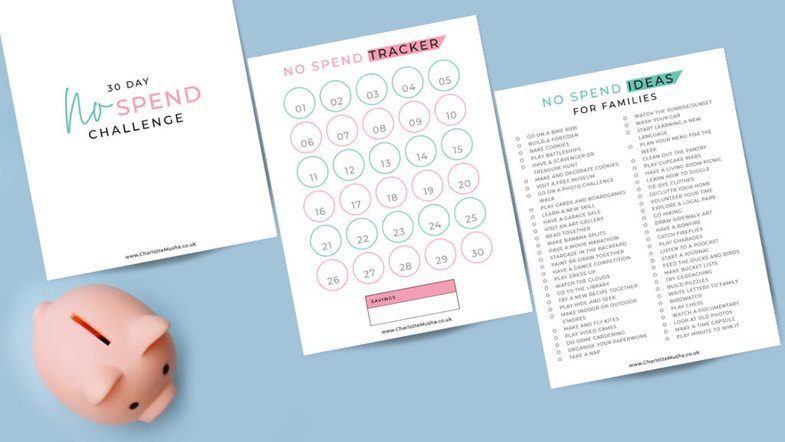

Simple in theory, but complicated in practice! For 30 days, you stop any expenses that are not necessary. This means: no online shopping, no shopping at the perfumery and no dinner with friends. Exceptions are made only for basic things, such as bills, food and necessary expenses.

Does it really work?

Financial experts have different opinions. According to Kendall Meade, a financial planner, this challenge can help achieve short-term goals, but it also has risks. "People who limit their spending drastically may end up spending more after the challenge, as a sort of revenge," she says.

Tara Minetos, another financial expert, shares the same opinion. She compares this challenge to extreme diets: "If you don't change your mindset and lifestyle, such a strict method cannot give long-term results."

Meanwhile, Lawrence Sprung, a financial planner and author, warns of another danger. According to him, people who don't use this challenge as a lesson to change their habits may end up spending more after it's over.

Who is this challenge for?

Although not ideal for everyone, the challenge can be useful for those who want to regain control over spending or try a financial "detox". This method can help you understand which expenses are unnecessary and which ones you can't cut out of your life.

An ideal outcome, she says, is creating a balanced budget that includes some luxuries while helping you reach long-term financial goals.

Advantages and disadvantages

Like any other method, the no-cost challenge has its pros and cons:

Advantages:

Helps restore spending habits

Creates an emergency savings fund Helps achieve short-term savings goals

Reduces unnecessary spending

Disadvantages:

It's not a long-term financial plan

It can cause "financial revenge" after the challenge month

It takes a lot of discipline

Extreme savings can damage your relationship with money

Is it for you?

If you see this challenge as a way to restart your financial habits, then you can give it a try. But remember: balance is key. Instead of stopping all spending, consider a more moderate approach. For example, cut back on impulse purchases or limit dining out to once or twice a week.

@shake.your.assets The first two years of saving we barely bought anything from our "want" category. That may seem like no fun, but watching our savings grow so we could buy a home was honestly the best feeling. #savemoneytips #moneytalk #underconsumption #nospendchallenge ? original sound - Shake Your Assets ?

@beccanomics101 What we did instead of spending money this weekend #whatispend #budget #getoutofdebt #payoffmortgage #nospendchallenge #debtpayoff #whatispendinaday ? original sound - Becca Bergmann

Suggested articles: