In today's times, comfort and speed are essential in the provision of financial services, at least in developed countries such as America or European Union countries. If a consumer's mind first goes to services such as payments and transfers, the same has long been the case when it comes to getting a pair of sneakers in installments through a small consumer loan.

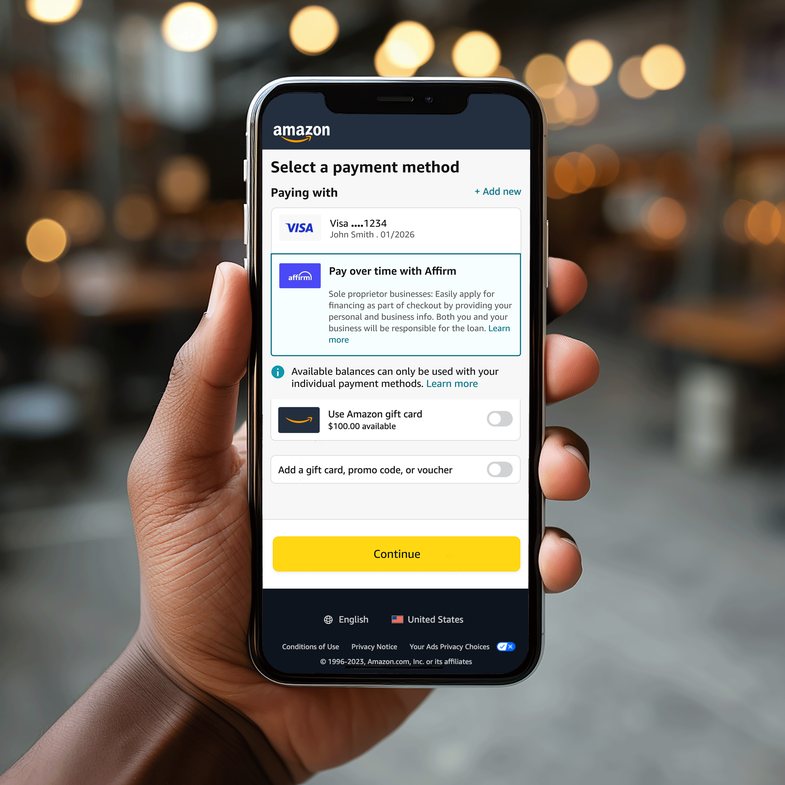

The websites of large chain stores but also those of smaller online stores offer the purchase of their product in 3-5 installments through a completely digital process, i.e. from a smartphone and 24/7.

How is the situation in Albania? From our observation, very few businesses offer on their websites the purchase of products in installments, but the good news is that this number is coming and expanding, driven by the demands of the younger generations for online shopping, as well as by the innovative approaches of a few institutions. financial institutions that offer this service.

The responsibility of all market actors who have in hand the development or not of online shopping and the provision of credit within online shopping platforms ranges from regulators to the end customer. Everyone should do their part in a way that not only limits the concept of "webshop" and "Buy Now Pay Later" but promotes it as one of the contributors to the growth of consumption, payment of taxes and consumer satisfaction.

Small consumer loans should be accessible quickly, effortlessly and digitally – just as they have been for years in Europe, America and other developed markets. However, surprisingly, there are some perspectives that see this ease of access to financing as negative. While many countries measure progress by how easy and fast it is for consumers to access financing, it is noticeable that the opposite mentality is often promoted.

In most developed economies, financial institutions are connected in real time to national databases, allowing them to obtain the necessary information - such as income data - instantly, and all with the consent of the client. This simplifies the entire loan approval process, making it faster and more efficient.

* Article taken from sources outside the Anabel editorial office.